Not known Details About Offshore Banking

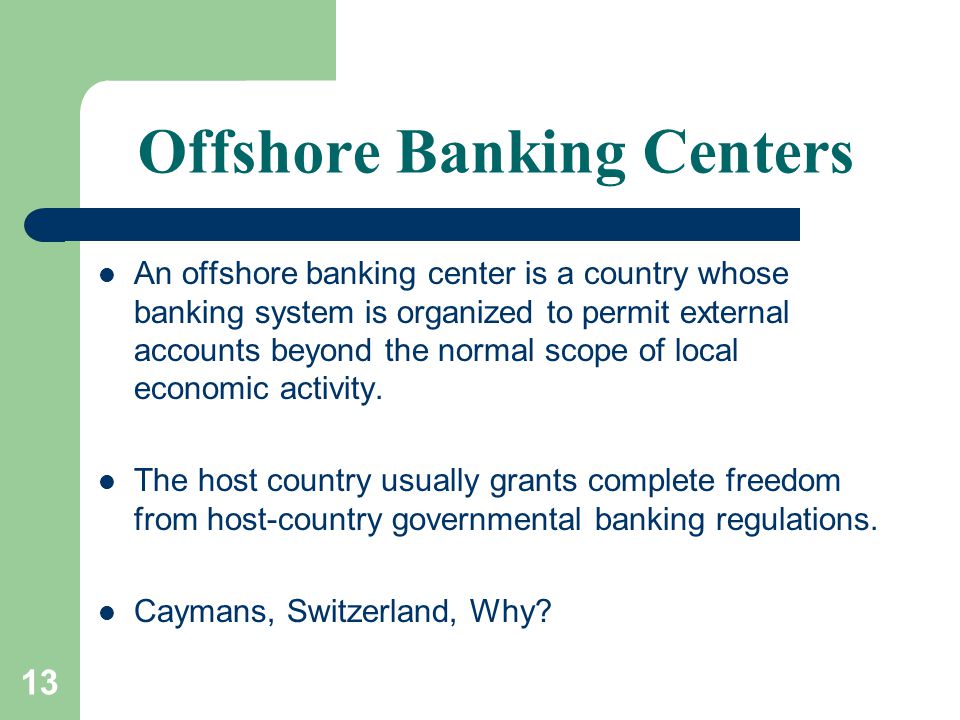

Bank situated outside the country of house of the depositor An overseas financial institution is a financial institution controlled under international financial permit (frequently called offshore permit), which normally forbids the financial institution from developing any business activities in the territory of facility. Due to much less guideline and transparency, accounts with overseas banks were often used to conceal undeclared revenue. OFCs commonly additionally impose little or no corporation tax obligation and/or individual income as well as high straight taxes such as obligation, making the expense of living high.

Many other offshore territories likewise give overseas banking to a better or lesser degree. In certain, Jersey, Guernsey, and the Island of Man are additionally known for their well controlled banking facilities. Some overseas jurisdictions have actually guided their financial fields away from offshore banking, thinking it was challenging to correctly regulate and also reliant offer surge to economic scandal.

OFCs are stated to have 1. A group of protestors state that 13-20 trillion is held in overseas accounts yet the actual figure can be a lot higher when taking right into account Chinese, Russian and also US deployment of capital worldwide.

The 7-Minute Rule for Offshore Banking

Similar to a criminal using a pocketbook recognized and taken as earnings of crime, it would certainly be counterproductive for any person to hold possessions extra. A lot of the resources streaming with cars in the OFCs is aggregated financial investment resources from pension funds, institutional and personal financiers which has to be released in industry around the Globe.

Banking benefits [edit] Offshore financial institutions provide access to politically and financially secure jurisdictions. This will certainly be an advantage for citizens of locations where there is a danger of political turmoil, who fear their possessions may be frozen, seized or disappear (see the for instance, during the 2001 Argentine financial situation). It is also the case that onshore banks provide the exact same advantages in terms of stability.

Advocates of overseas financial commonly identify federal government regulation as a kind of tax obligation on domestic banks, minimizing rate of interest on deposits. However, this is hardly real now; most offshore nations supply extremely similar rate of interest to those that are supplied onshore as well as the offshore banks currently have substantial conformity requirements making certain classifications of clients (those from the United States or from greater danger profile countries) unattractive for different factors.

The Ultimate Guide To Offshore Banking

Those that had transferred with the very same financial institutions onshore [] gotten every one of their cash back. [] In 2009, The Island of Guy authorities were keen to explain that 90% of the complaintants were paid, although this only described the number of people that had actually obtained cash from their depositor payment scheme and not the amount of cash reimbursed.

However, just offshore centres such as the Island of Guy have actually refused to compensate depositors 100% of their funds following financial institution collapses. Onshore depositors have actually been refunded completely, despite what the settlement limit of that nation has specified. Hence, banking offshore is historically riskier than financial onshore. Offshore financial has actually been associated in the past with the underground economic situation as well as arranged crime, thanks to films such as the Company with cash laundering.

Offshore banking is a legitimate financial solution used by lots of migrants as well as worldwide employees. Offshore jurisdictions can be remote, as well as consequently costly to check out, so physical accessibility can be hard. Offshore personal financial is typically a lot more obtainable to those with higher earnings, because of the prices of developing and also maintaining offshore accounts.

Offshore Banking Fundamentals Explained

1 Record of Foreign Financial Institution as well as Financial Accounts (FBAR: Each person or entity (consisting of a bank) subject to the territory of the United States having an interest in, signature, or other authority over several financial institution, protections, or various other economic accounts in a foreign nation need to file an FBAR if the accumulated worth of such accounts at any type of point in a fiscal year goes beyond $10,000.

24). A recent [] Area Litigation in the 10th Circuit may have significantly increased the meaning of "interest in" and also "other Authority". [] Offshore checking account are in some cases proclaimed as the option to every legal, monetary, and possession protection method, but the benefits are often overstated as in the more famous jurisdictions, the level of Know Your Consumer evidence needed underplayed. [] European suppression [edit] In their initiatives to mark down on cross border rate of interest payments EU federal governments accepted the introduction of the Financial savings Tax Regulation in the kind of the European Union withholding tax obligation in July 2005.

This tax affects any cross border rate of interest repayment to a private resident in the EU. Additionally, the price of tax obligation deducted at resource has actually increased, making disclosure progressively eye-catching. Savers' option of action is complex; tax authorities are not prevented from enquiring into accounts previously held by savers which were not after that divulged.

The Definitive Guide for Offshore Banking

e. no one pays any tax obligation on offshore holdings), and the just as curious story that 100% of those down payments would or else have been liable to tax obligation. [] Projections are often based upon levying tax obligation on the funding sums kept in offshore accounts, whereas the majority of nationwide systems of taxation tax obligation income and/or resources gains instead of built up riches - offshore banking.

A large section, 6. 3tn, of offshore possessions, is owned by only a little sliver, 0. 001% (around 92,000 incredibly rich people) of the globe's population. In simple terms, this mirrors the hassle linked with establishing these accounts, not that these accounts are just for the wealthy. A lot of all people can make the most of these accounts.

i thought about this Bonuses try this site